In order to assess the potential of car-sharing implementation in Russia we need to make a PESTEL analysis.

Political factors

–Governmental plans

There is a plan of traffic jams reduction by 2016. By 2016, the authorities intend to increase the average speed by 17% through a variety of measures (source – Financial Times).

–Taxes and duties

Russian government has introduced higher vehicle tax rates depending on the engine power and proposed to rduce this tax for electric cars. The import duty on eco-cars was removed.

–Subsidies

Regional subsidies for ecological projects.

Economic factors

There is a real income growth by 2.5%. Growth of real wages accelerated in February to 6% compared with 5.2% in January 2014, for the first two months, an increase of 5.6%. The unemployment rate remains approximately the same (5.4%).

Gasoline prices started to increase more for the recent time.

- Annual increase of gas price

Social factors

–Environment

There are several ecological societies with successful propaganda of emission reduction (people start to care more about ecology).

–Car Usage Culture

According to Russian Public Opinion Research Center, 42% of Russian citizens drive a car. And this indicator continues to grow by about 2-3% per year. However, in big cities, such as Moscow or St. Petersburg 44% don’t drive to work due to trafiic jams. Moreover, there is still a trend among the population to drive their own car.

Technological factors

Growth of internet expansion

- Allocation of IPv4 Address Space

Using the internet and social networking sites such as Facebook, Vkontakte are the hottest trends of

this decade.

– Progress of applications development

There is a significant increase of using mobile devices, such as iPhone and Android or Windows-based one. Thus, people have become to use different applications almost everyday, especially booking for plane, train or cinema tickets, hotel room etc.

– Infrastructure

Lack of parking places in major cities, which is a serious problem as well as traffic jams in big cities.

Environmental factors

There is a huge amount of emissions, which causes air pollution and bad ecological situations, especially in big cities. The following graph shows us that passenger vehicle emissions comprise two-thirds of that total. What is

more, vehicle emissions are one of the fastest growing sources of greenhouse gas emissions.

Sources of Emissions

Legal factors

There are environmental regulations – special standards for emissions and gas quality, governmental plans to cut the emissions. Moreover, every vehicle should have an obligatory regular technical examination.

In addition, there is a problem of bureacracy for doing such a business in Russia.

To sum up the most important factors, which causes an opportunity for car sharing implementation in the Russian market are political, legal and environmental factors, which encourage eco-projects and technological development which helps to deal with customers easier. However, there are also obstacles, such as already existing lack of parking places and high importance of car ownership for people.

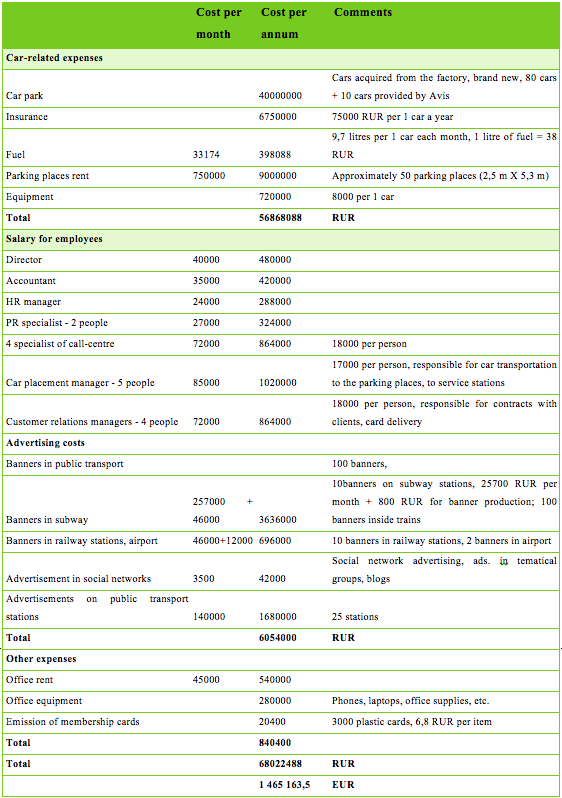

Car sharing is a business which demands heavy investments. Most of them are demanded for acquiring a car fleet and installing the necessary equipment. In in oder to make the picture more clear, we propose a rough estimation of the budget for the first year (Saint-Petersburg). We suggest to acquire 90 cars of different models, and we also expect Avis group to provide us with 10 additional cars. Also we have a rough estimation of the employees salaries expenses, rent of the office, etc. Quite significant investments are demanded for the marketing campaign. We suggest to place banners in various places, such as subways stations, subway trains, railway stations, airport and on the ground transport stations. Thus we will be able to reach the wide audience and attract potential customers to Zipcars

Car sharing is a business which demands heavy investments. Most of them are demanded for acquiring a car fleet and installing the necessary equipment. In in oder to make the picture more clear, we propose a rough estimation of the budget for the first year (Saint-Petersburg). We suggest to acquire 90 cars of different models, and we also expect Avis group to provide us with 10 additional cars. Also we have a rough estimation of the employees salaries expenses, rent of the office, etc. Quite significant investments are demanded for the marketing campaign. We suggest to place banners in various places, such as subways stations, subway trains, railway stations, airport and on the ground transport stations. Thus we will be able to reach the wide audience and attract potential customers to Zipcars